Invest in Your Debt-Free Future - Zurich ValueLife Pluz

Plan For A Debt-Free Future

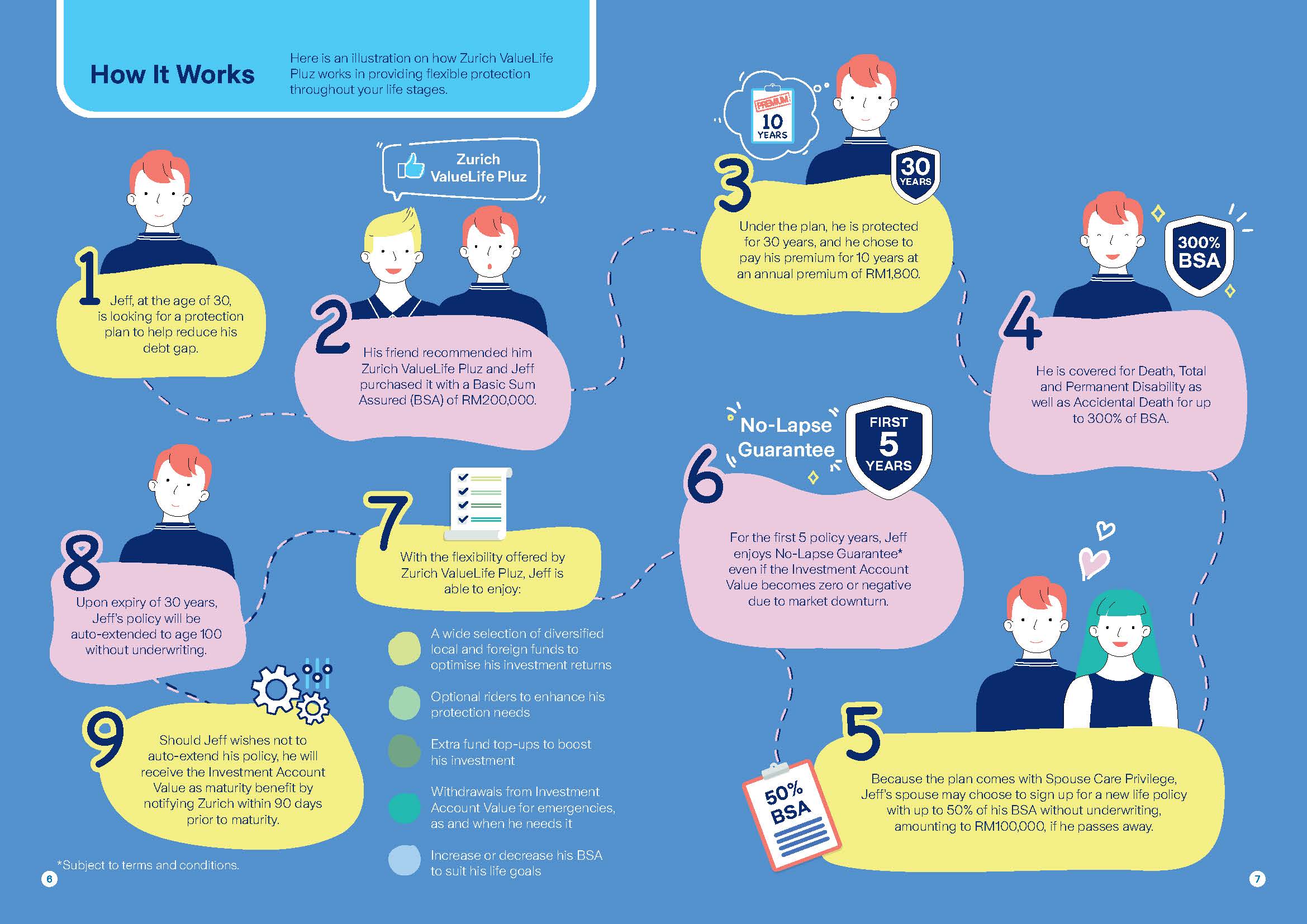

Zurich ValueLife Pluz is an investment-linked plan that provides a combination of financial protection and investment with coverage term of 30 years. Pick your premium payment term, sum assured and funds combination to match the levels of savings, financial protection and wealth accumulation required to suit your needs.

Note: This is an insurance product that is tied to the performance of its underlying assets and is NOT a pure investment product like unit trusts.

High protection of up to 300% of Basic Sum Assured (BSA)

Provides comprehensive protection against unfortunate events.

| 100% of BSA + IAV4 | Death or Total and Permanent Disability1 (TPD) |

| 300% of BSA + IAV4 | Public Conveyance Accidental Death2 |

| Overseas Accidental Death3 |

1 The TPD coverage is only up to age 70 of the Life Assured.

2 In the event of death of the Life Assured within 365 days from the date of accident occurred while commuting in Public Conveyance.

3 In the event of death of the Life Assured within 365 days from the date of accident occurred while travelling overseas for not more than 90 consecutive days per trip.

4 The Policy Owner will also receive the amount in the Investment Account Value (IAV), if any.

Note: Only the highest payout as listed in the table above will be paid.

You are in control of your insurance plan

You can choose a premium payment term of 5 years, 10 years or 20 years for a 30-year coverage and may start investing from a wide selection of investment funds, according to your risk appetite.

If you have extra funds, you can channel it to the plan via top-ups. And in case you need money for an emergency, an option to withdraw from your investment account value is made available to you.

In addition, your policy will be auto-extended*, which provides continuous coverage up to age 100 upon expiry of the 30 years without underwriting.

*You may be required to pay an additional premium. We will notify you of the auto-extension and any additional premium required by giving you at least 90 days' notice in advance.

Spouse Care Privilege

This benefit provides continuous protection to the spouse of Life Assured where the spouse may sign up for a new life policy of up to 50% of BSA, with a maximum of RM500,000, without medical underwriting when the Life Assured passes on.

Note: Terms and conditions apply.

Optional riders to enhance your coverage

Attach any of the following riders for better protection:

- Critical Illness Rider

- Payor Benefit Rider

- Waiver of Premium Rider

Maturity benefit

Upon maturity, you will receive the following as maturity benefit.

| Maturity Age | Maturity Benefit |

| Below age 100 | Investment Account Value (IAV) |

Age 100 |

100% of Basic Sum Assured + IAV |

Note: You may need to top-up your premium along the way for continuous coverage.

No-Lapse Guarantee for the first 5 policy years

This valuable feature ensures continuity of coverage even if the Investment Account Value is zero or in the negative due to market fluctuations.

The premiums (including revision of premium payment and regular top-up as advised by Zurich) must be paid consistently on or before the due date and no withdrawal is made within the first 5 policy years.

Note: Any variation on premium and benefits are subject to the conditions determined by Zurich in order to enjoy this No-Lapse Guarantee. Terms and conditions apply.

Zurich ValueLife Pluz is open to anyone between 14 days old and 70 years old. However, the policy owner must be at least 16 years old.

The benefits payable are protected by PIDM up to limits and the protection on benefits from the unit portion is subject to limitations. Please refer to PIDM TIPS brochure or contact Zurich Life Insurance Malaysia Berhad or PIDM.