Affordable Protection for Your Family's Future - Zurich ValueLife Premier

For the Hero in you

You are the Hero of your family. You work hard to provide, nurture and protect them. But you are not invincible. Are you adequately covered for your loved ones if something happens to you?

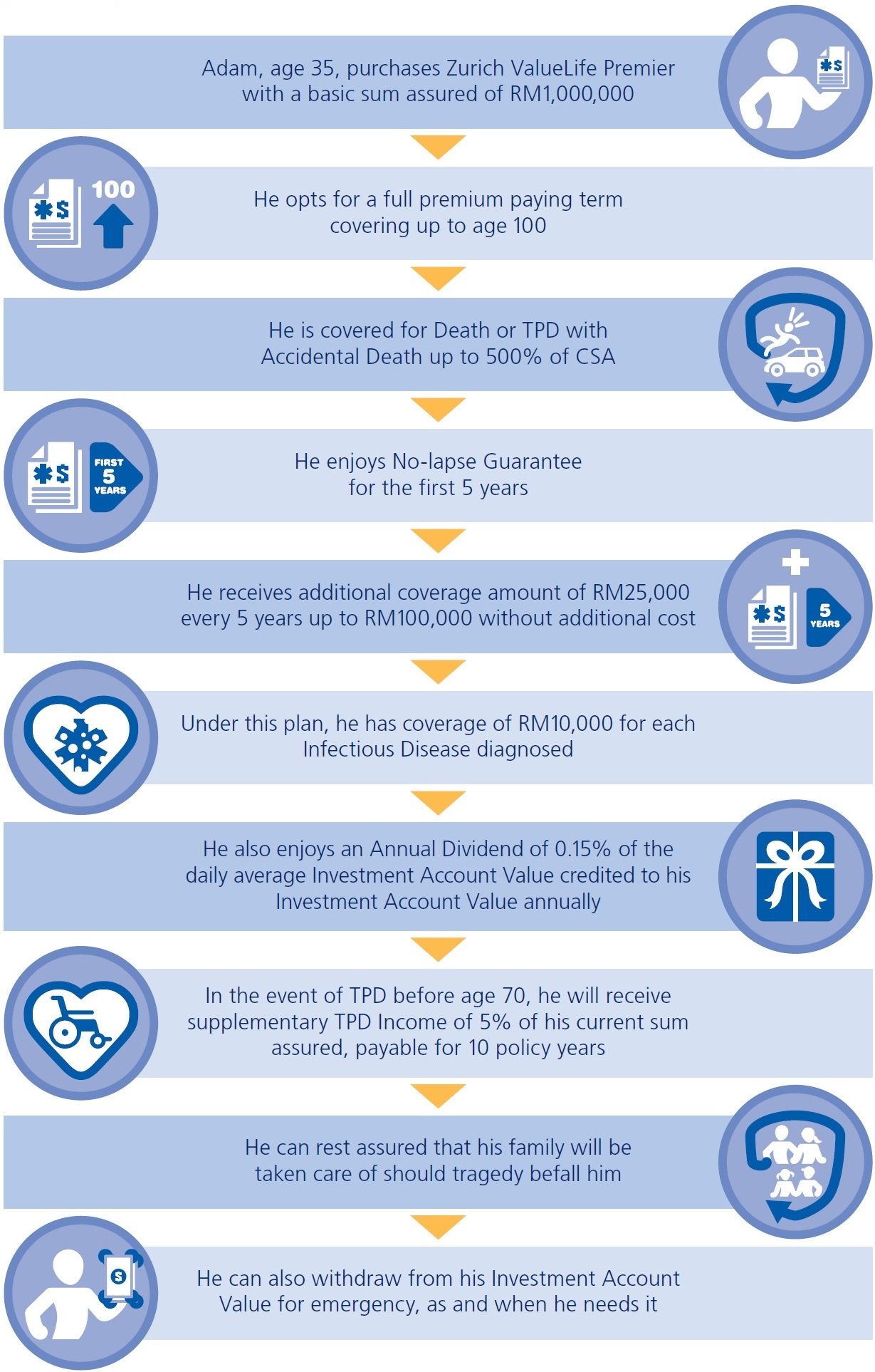

Adequate protection may not necessarily come at a high cost. Get high coverage with Zurich ValueLife Premier, an affordable regular premium investment-linked plan that works around your ever-changing lifestyle - be it for your newborn child, buying a new property or legacy planning for next generations. So no matter what happens, your family’s future can always remain certain.

Note: This is an insurance product that is tied to the performance of its underlying assets and is NOT a pure investment product like unit trusts.

Your Hero Powers:

High coverage up to age 100 with no medical check-up required*

Get unmatched protection for you and your loved ones with a higher coverage plan starting from RM500,000. Plus, no medical check-up is required1 for coverage up to RM4,000,000! Choose from the various coverage options to meet your needs - term coverage of 20 years, or continuous coverage up to age 70, 80 or 100 years. In addition, your policy term will be auto-extended2 up to age 100 without the need to go through underwriting.

1Depending on the age and health condition of the Life Assured.

2You may be required to pay an additional premium. We will notify you of the extension and any additional premium required by giving you at least three (3) months' notice prior to the extension.

Coverage up to RM8 million sum assured for Total and Permanent Disability (TPD)

This plan allows you to have TPD coverage up to a maximum of RM8 million sum assured per life.

Supplementary TPD Income for 10 years

If you suffer from TPD before the age of 70, you will receive TPD income of 5% of current sum assured per annum for 10 policy years.

Infectious Disease Benefit

If you are diagnosed with any of the infectious disease listed in the table below before age 70, you will be entitled to a lump sum of RM10,000 per infectious disease diagnosed. Each infectious disease is only claimable once.

| Infectious Disease | |||

| Age 15 and below | Age 16 and Above | ||

| Hand Foot Mouth Disease | Typhoid Fever | ||

| Measels | Ebola | ||

| Meningococcal Disease | Zika Virus | ||

| Mumps | Severe Acute Respiratory Syndrome (SARS) | ||

| Cholera | Nipah Virus Encephalitis | ||

| Tuberculosis | Influenze A - Avian Influenza A (H7N9) & (H5N1) | ||

| Hepatitis A | Malaria | ||

Note: Please refer to policy contract for detailed definitions of the infectious diseases covered.

Power-Ups:

Life protection up to 500% of current sum assured (CSA)

Get up to 500% on your insurance coverage amount in the event of unfortunate incidents as listed below:

| Insurance Coverage Amount | |

| 100% of CSA | For Death and TPD due to all causes |

| 200% of CSA | For Balik Kampung Accidental Death or TPD |

| 300% of CSA | For Public Conveyance Accidental Death |

| 400% of CSA | For Outside Malaysia Accidental Death |

| 500% of CSA | For On-Board Flight Accidental Death |

Should any of the incidents above happen, the amount payable shall be the higher of Insurance Coverage Amount or Investment Account Value.

Additional sum assured of RM25,000 every 5 years

Your basic sum assured increases by RM25,000 every 5 policy years without incurring additional insurance charges up to a maximum of RM100,000 per policy.

No-lapse Guarantee for first 5 years

Even if your investment account value is insufficient to cover the cost of insurance and fee charges due to market fluctuations, your Zurich ValueLife Premier will continue to be in-force and provide coverage. The premiums (including revision of premium payment as requested by the Company) must be paid consistently before the due date and no withdrawal is made within the first 5 policy years.

Note:

Any variation on premium and benefits are subject to the conditions determined by the Company in order to enjoy this No-lapse Guarantee. Terms and conditions apply.

Flexibility to choose premium payment terms

You have the complete flexibility to choose from one of the 4 premium payment terms below:

| 5 years | 10 years | 20 years | Full policy term |

Rewards and investment opportunities

As you stay covered with Zurich ValueLife Premier, you will be rewarded with Annual Dividend in the amount of 0.15% of the daily average Investment Account Value for the past one year. You can also optimise your investment by investing in a wide range of diversified Zurich local and foreign funds to generate potential investment returns.

Options to enhance your coverage

You can provide additional coverage to safeguard your loved ones by enhancing your protection coverage with the following riders:

- Payor Benefit Rider

- Critical Care Essential

- Critical Care Premium Waiver

For further details of terms and conditions, please refer to product disclosure sheet, sales illustration and policy documents.

You can be insured if you are between 30 days and 70 years old. However, the policyholder must be at least 16 years old.

The benefits payable are protected by PIDM up to limits and the protection on benefits from the unit portion is subject to limitations. Please refer to PIDM TIPS brochure or contact Zurich Life Insurance Malaysia Berhad or PIDM.