Secure Your Family's Future with Guaranteed Benefits - Executive20

Enjoy life to the fullest with guaranteed benefits

Nobody can predict what tomorrow brings. But instead of leaving your loved ones’ future to chance, you can take proactive steps to ensure their financial security. Start your preparation with Executive20, a unique Family Takaful plan that offers guaranteed protection and annual cash payment. In an uncertain world, it’s a great way to show them you care, while ensuring your own peace of mind.

You only need 5 reasons to choose Executive20!

![]()

Annual Cash Payout

Earn Annual Cash Payouts from the Participant Risk Investment Account (PRIA) from the end of the 2nd certificate year onwards until your certificate matures; with the flexibility to choose the payout option amounting to 4% or 6% of the Basic Sum Covered.

![]()

Guaranteed Takaful Coverage

Your family and loved ones will be financially protected should the unexpected happen to you. Get Guaranteed Death Benefit up to age 90, and Guaranteed Total Permanent Disability (TPD) up to age 75 from the Participant Risk Investment Account (PRIA).

![]()

Maturity Benefit

Receive the Maturity Benefit, which is equal to the Participant Investment Account (PIA) value when your certificate matures.

![]()

Enhanced Coverage Option

With optional supplementary benefits offers, you can optimise your protection against unexpected events such as Critical Illnesses, Death or Total Permanent Disability.

![]()

Conversion Option

You can extend your protection with selected Zurich Takaful products after your certificate matures, with no health evidence required!

Note: Terms and conditions apply.

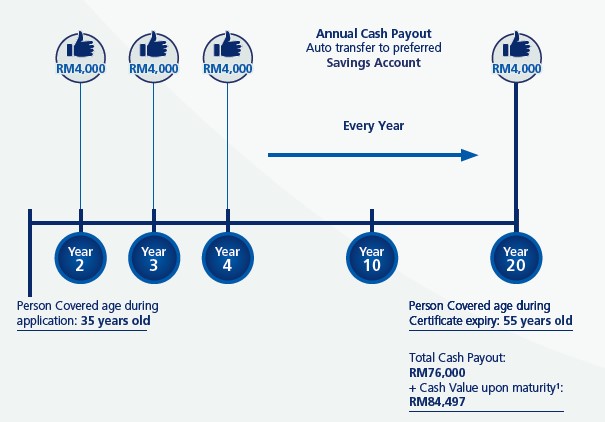

The diagram is for illustration purposes only, which is based on the following criteria:

Basic Sum Covered: RM100,000

Cash Payout Option: 4% of Basic Sum Covered

Age Last Birthday: 35 Years Old

Monthly Contribution: RM698.58

Coverage Term: 20 years

1Based on assumption of 5% return every year. PIA value is based on the actual performance and it is not guaranteed.

Anyone between 30 days till 65* years old is eligible to participate in the Executive20 plan. Age is based on Age Last Birthday (ALB).

*Only applicable for 20 years of basic coverage term.

Zurich Takaful operates under the principle of Wakalah, whereby the Takaful Operator acts as an agent to the Participant for managing the operations of the Takaful business. A Wakalah Fee will be charged up-front from the contributions made. Tabarru’ (donation) will be deducted to the Participant Risk Investment Account (PRIA), where it will be used for mutual aid and assistance, based on the concept of Takaful. The benefits are paid from the PRIA only upon a covered loss, and not upon maturity or surrender of the certificate. Surplus Sharing (if any) at the end of each financial year will be shared between the Participant, and Zurich Takaful at a 50:50 ratio. The investment profit earned on the Participant Investment Account (PIA) is derived from the return on underlying assets and Zurich Takaful charges a Wakalah Bi al-Istithmar Fee (Investment Agency Fee) for managing these assets. The investment risk in PIA is fully borne by the Participant. 100% of investment profit earned, net of tax, less the aforementioned Wakalah Bi al-Istithmar Fee, will remain in the PIA for the benefit of the Participant. There will be no further sharing of the investment profit arising in the PIA with Shareholders.

The benefits payable are protected by PIDM up to limits. Please refer to PIDM TIPS brochure or contact Zurich Takaful Malaysia Berhad or PIDM.