Z-Miles: Pay-per-kilometre car takaful

Drive less? Pay less!

Save money on your comprehensive car takaful by paying based on the kilometres your car travels, plus a small annual contribution.

The new type of car takaful

Z-Miles offers the same coverage as any regular comprehensive car takaful, but your takaful contributions are calculated based on the kilometres your car travels, along with a small annual base contribution. You can use MyZurich app (download via Google Play Store or Apple App Store) to keep track of your car's kilometres driven and takaful contribution.

.png?iar=0&w=750)

Don't pay more than you'll drive

Pay a low base contribution and top up monthly based on the kilometres your car travels. So, you won't need to pay more than you'll drive.

Spread your takaful contribution

Say goodbye to big annual contribution and enjoy the flexibility to contribute monthly without interest payments. This way, you can manage your money better.

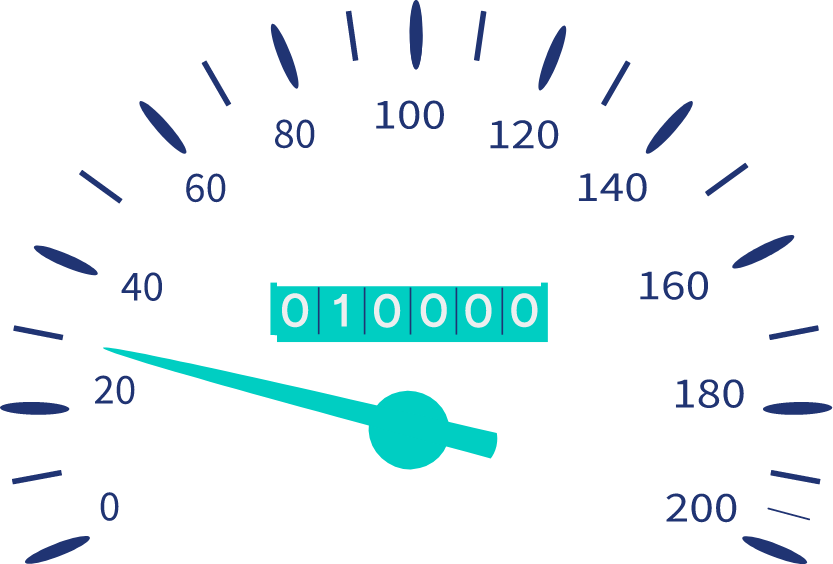

Capped mileage costs

Don't worry about driving too much - the most we'll charge you in a single day is 400km. Additionally, only the first 15,000km count in a year.

.png?iar=0&w=750)

Full Special Perils coverage

Be protected up to 100% of your car's sum covered against loss or damage caused by natural perils, including floods, storms and landslides.

.png?iar=0&w=750)

Unlimited breakdown towing

If your car breaks down, we’ll tow it to your preferred workshop, with unlimited distance covered in Malaysia.

.png?iar=0&w=750)

Press a button to request for assistance

Engage Zurich Roadside Assistance directly in the app or by pressing a button on your Z-Miles Device.

Who is Z-Miles for?

Z-Miles Takaful is best for those who drive less and who want more financial freedom.

How Z-Miles works?

Z-Miles contribution has two components: you pay a low base contribution at the start of your certificate, plus a rate for each kilometre your car travels. For example, Suraya owns a Proton X70 and pays a RM965 yearly contribution for her car takaful. When Suraya signs up for Z-Miles:

When Suraya participate in Z-Miles, her upfront contribution is RM430. This covers:

- RM330 for the base contribution for her third-party cover, and

- a prepaid mileage contribution of RM100 for the comprehensive cover, which includes up to 2,000km.

The prepaid mileage contribution is calculated based on a rate of RM0.05 per km that is specific to Suraya's risk profile, and this rate is fixed throughout the coverage term unless Suraya makes changes to her certificate.

Here's how we work out Suraya's monthly mileage contribution: we'll subtract the kilometres Suraya drives from her prepaid mileage balance. At the end of the month or when her prepaid mileage reaches a balance of 400km in the month, Suraya needs to top-up her prepaid mileage to 2,000 km.

For example, if Suraya covers 500KM in a month, she'll pay RM25 (500KM x RM0.05) as the monthly mileage contribution. In short, Suraya's monthly mileage contribution will vary depending on her car usage.

Z-Miles in comparison

An affordable alternative to regular private car comprehensive takaful.

| Z-Miles | Z-Driver Comprehensive | |

| Pay only for the kilometres your car travels | ✓ | |

| Monthly contribution payment | ✓ | |

| Third party liability | ✓ | ✓ |

| Loss or damage to your car due to accident, fire or theft | ✓ | ✓ |

| Up to 55% No Claim Discount | ✓ |

✓ |

| Complimentary windscreen repair due to chip and crack up to RM200 | ✓ |

✓ |

| Full Special Perils: Covers loss or damage to your car due to natural disasters such as floods and landslides up to the car's sum covered | ✓ |

Optional |

| Unlimited towing distance in event of car breakdown | ✓ | Optional |

| Agreed Value: You set the value of your car when you take out the certificate. If it's written off or stolen, we'll pay out this amount | Optional |

Optional |

| Choice of additional covers such as windscreen, passenger liability, driver and passenger personal accident etc. | Optional | Optional |

Frequently asked questions

We have a few restrictions in place and if you don’t fulfil the requirements below, you will not be able to get a Z-Miles policy/certificate from us at the moment:

- Z-Miles policy/certificate is only available for individual policy/certificate holders only

- When you first purchase/ participate in Z-Miles, your car’s sum insured/covered must be between RM30,000 and RM500,000

- Your car must have a working 12V socket to power the Z-Miles device

- You agree to plug in the Z-Miles Device in your car during the duration of cover

The idea behind Z-Miles is simple.

If your car is not in use, you’ve a lower risk of getting into an accident and making a claim. So, if you drive less frequently, you might be paying more than you need for your insurance/takaful. With Z-Miles, you pay upfront:

- An annual base premium/contribution to cover your car against third party liabilities and when your car is parked for the insurance/certificate period of coverage, and

- Prepaid mileage premium/contribution that covers your driving for 2,000 km, based on a

per-kilometre rate that is specific to you.

Automatic billing feature:

- After each trip, the distance your car has travelled gets deducted from the prepaid mileage. Your prepaid mileage balance will be automatically topped up monthly, or when it falls below 400 km during the month to ensure your car always has comprehensive coverage.

- Top-up mileage premium/contribution is calculated by multiplying the per-kilometre rate by the mileage needed to bring the prepaid mileage back to 2,000 km.

- To help you control your insurance/takaful cost, we’ve set limits on the mileage you pay for. You’ll never be charged for more than 400 km in a day, this simply means, if you drive more than 400 km in a day – any extra distance you drive is on us! We’ll never charge you for more than 15,000 km a year either.

We’ll refund/return any unused prepaid mileage at the end of the period of insurance/certificate coverage. In other words, you only pay for the kilometres your car is driven – similar to a mobile phone bill.

There's no mileage limit - you can drive as much as you like. We've designed Z-Miles to save lower mileage drivers money, but we don't enforce a limit on how many kilometres you can drive.

However, to help you control your insurance/takaful cost, we’ve set limits on the mileage you pay for. You’ll never be charged for more than 400 km in a day or 15,000 km for the year. This simply means, if you drive more than 400 km in a day or 15,000 km in a year – any extra distance you drive is on us!

You'll need a Visa or Mastercard debit or credit card to pay your insurance/takaful premiums/contributions.

We'll automatically take payment from the same card to top-up your prepaid mileage balance to 2,000 km every month or when your prepaid mileage balance is low during the month.

You can update your billing details on MyZurichLife Customer Portal at any time.

Unfortunately, we are not able to take American Express, Diners Club, or pre-paid cards at the moment.

You may cancel your policy/certificate at any time by giving us a written notice in advance. Upon cancellation, you are entitled to a partial refund/return of base premium/contribution and unused mileage balance, provided you have not made any claim. There is no refund/return of mileage premium/contribution for the mileage that you have driven during the insurance/takaful coverage period.

Prior to cancelling your Z-Miles policy/certificate, you need to ensure your road tax is cancelled first and provide the evidence of road tax cancellation to us when you cancel your policy/certificate.

Meet a Zurich Takaful Agent

Locate Your Nearest Zurich Branch

Contact Our Zurich Call Centre

Download a copy of the complete FAQs below