Affordable Takaful Plan with High Protection - Takaful ProSecure

For the Continuity of Lifestyle

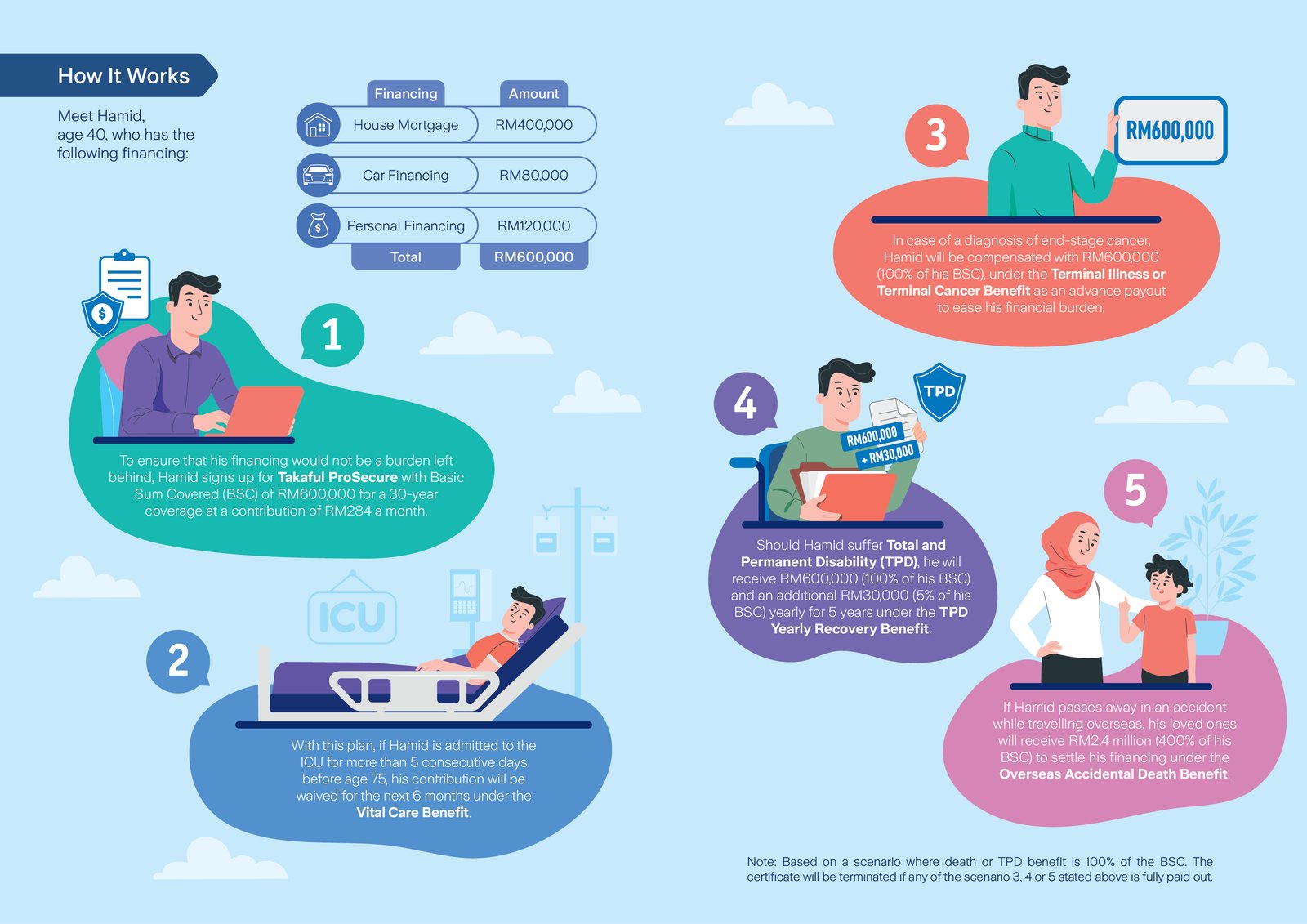

Introducing Takaful ProSecure, an affordable takaful plan, thoughtfully designed to ease your burdens during challenging situations and protect your family and assets, while preventing debt accumulation.

![]()

High Protection of up to 400% of Basic Sum Covered

In case something happens to you, this plan will provide the following:

| Death / Total and Permanent Disability / Golden Age Disability | Higher of 100% of the Basic Sum Covered (BSC) or Total Contribution Made |

| Public Transport Accidental Death | Death Benefit + 200% of BSC |

| Overseas Accidental Death | Death Benefit + 300% of BSC |

![]()

Disability Support Plan

Be covered for Total and Permanent Disability up to age 75, along with continuous coverage for Golden Age Disability until the end of certificate.

![]()

Terminal Illness or Terminal Cancer Benefit

If you are diagnosed with Terminal Illness or Terminal Cancer, receive 100% of your Basic Sum Covered or Total Contribution Made, whichever is higher.

![]()

TPD Yearly Recovery Benefit

Receive an additional 5% of your Basic Sum Covered, payable yearly for 5 years from the occurrence of Total and Permanent Disability.

![]()

Vital Care Benefit

Have your contribution waived for the next 6 months if you are admitted to an Intensive Care Unit (ICU) more than 5 consecutive days.

![]()

Enhanced Family Accidental Death Benefit

If any of your 4 family members including parents, spouse or children pass away due to an accident, you receive a lump sum of RM10,000 per family member.

![]()

Family Care Privilege

Up to 4 of your family members will get to participate in a new Takaful certificate with coverage of up 25% of the Basic Sum Covered each, without medical underwriting when you are no longer around.

![]()

Enhance Your Protection with Riders

You have the option to extend your coverage even more by attaching any of the following riders:

| VitalGuard Prime | Provides additional coverage for 51 Critical Illnesses at an affordable contribution and the rider sum covered paid will reduce the Basic Sum Covered. |

|

VitalGuard Essential |

Provides additional coverage against 51 Critical Illnesses and the Basic Sum Covered remains unaffected. |

| VitalGuard Waiver | Provide continuous coverage with your basic contributions waived in the event you are diagnosed with any one of the 50 Critical Illnesses. |

The minimum entry age of the Person Covered for this plan is 14 days old and the maximum entry age is subject to the coverage term of your choice. However, the Participant must be at least 16 years old.

| Coverage Term | Minimum Entry Age | Maximum Entry Age | ||

|

10 years |

14 days old | 70 years old | ||

| 20 years | 60 years old | |||

| 30 years | 50 years old | |||

The benefits payable are protected by PIDM up to limits. Please refer to PIDM TIPS brochure or contact Zurich Takaful Malaysia Berhad or PIDM.