Affordable Medical Coverage Within Your Budget - Zurich iCare Medic

Big journeys begin with small steps. Start here.

There is no better time to start an insurance plan coverage than now.

Introducing Zurich iCare Medic. Discover how this plan is made for you, providing just what you need. You will love how this entry level medical plan fits your budget and yet provides the medical care and attention you deserve.

Easy Hospital Admission

Worry not about having cash on hand. Just show your medical card at any one of our panel hospitals for a hassle-free admission.

Covid-19 Coverage

If you contract Covid-19 or experience Covid-19 vaccination side effects, you are well covered for hospitalisation admission1.

Affordable Premium with Long-Term Protection

Get protected and enjoy medical coverage with no lifetime limit up to 100 years of age. No excuses for not living your life to the fullest.

Enjoy More Savings

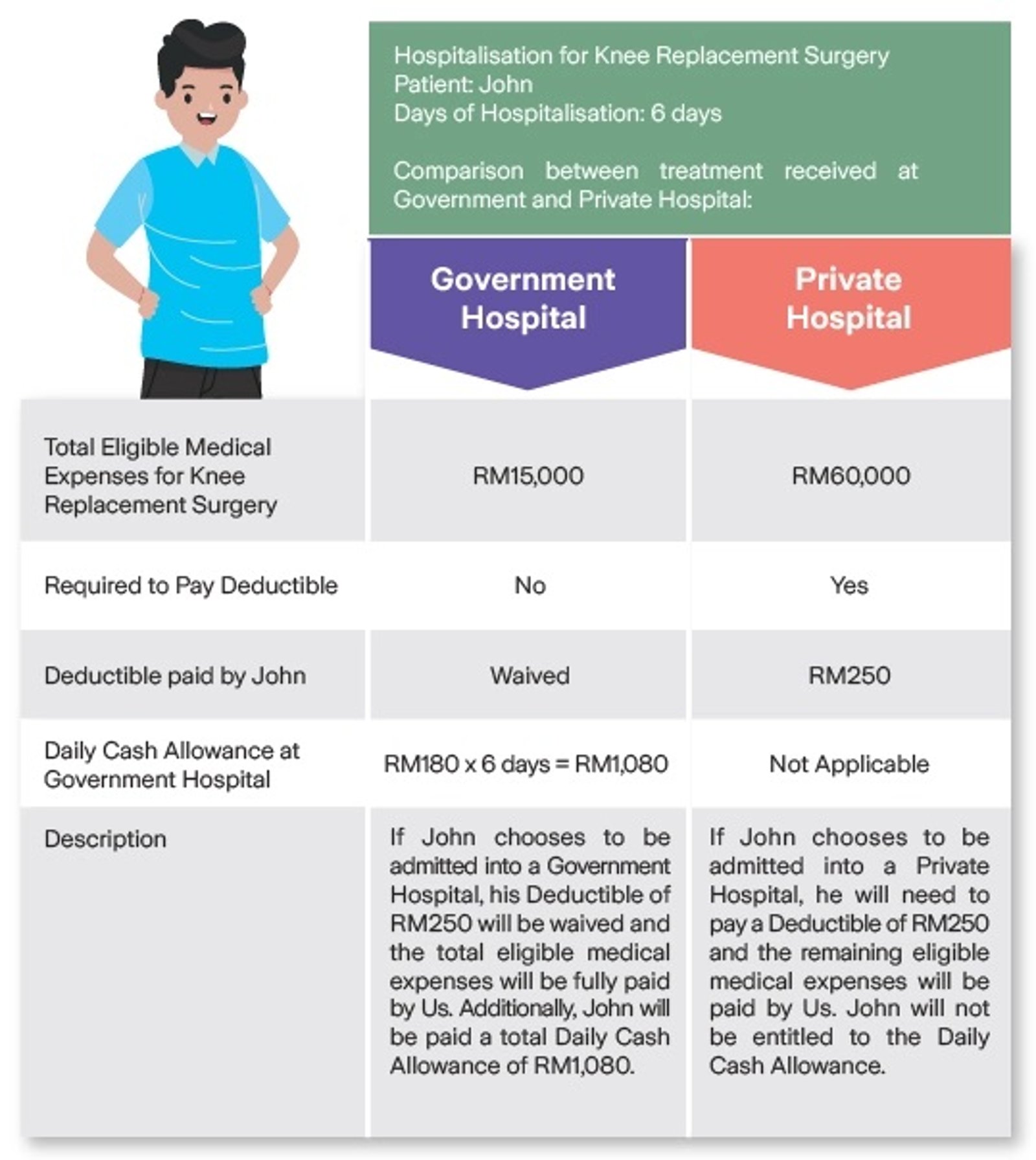

Your medical bills are well taken care of. Have your Deductibles waived so that you can focus on recovering whilst enjoying Daily Cash Allowance of RM180 if you are admitted into a government hospital.

Compassionate Benefit

In the event of death of the Life Assured, your family will receive RM10,000 to assist them with funeral expenses.

Step Up Advantage

Enjoy the option of upgrading your plan to a new medical plan after 5 years and enhance your benefits in the future with a more comprehensive medical protection. No medical underwriting required and is subject to terms and conditions.

Note:

1Life Assured must be vaccinated with at least 2 doses of vaccine approved by local authority to be entitled for this benefit [except for Life Assured age 4 years and below.]

| Plan | Plan 180 | |||

| Limit (RM) | ||||

| Annual Limit (for In-Patient Benefits, Out-Patient Benefits plus Other Benefits) |

500,000 | |||

| Lifetime Limit | No lifetime limit | |||

| Deductible (amount per Policy Year) |

250 | |||

| In-Patient Benefits | ||||

| 1 | Daily Hospital Room & Board (limit per day, unlimited number of days) |

180 | ||

| 2 | Daily Cash Allowance at Government Hospital (limit per day, unlimited number of days) | 180 | ||

| 3 | Intensive Care Unit or High Dependency Unit (maximum 120 days per Policy Year) | As Charged, subject to any Deductible. Deductible will be waived for admission to Malaysian Government / Semi-Government Hospital. | ||

| 4 | Hospital Supplies & Services | |||

| 5 | Surgical Fees | |||

| 6 | Anaesthetist Fees | |||

| 7 | Operating Theatre Fees | |||

| 8 | Ambulance Fees | |||

| 9 | Pre-Hospitalisation Diagnostic Tests (within 90 days prior to Hospitalisation) • Diagnostic Tests • Specialist / General Practitioner Consultation • Medication and Treatment |

|||

| 10 | In-Hospital Specialist Visit • Surgical – unlimited number of visits • Non-surgical – max 2 visits/day |

|||

| 11 | Post-Hospitalisation Treatment (within 180 days after discharge) • Diagnostic Tests • Specialist Consultation • Medication and Treatment |

|||

| 12 | Organ Transplant (any organ, unlimited number of transplant) |

|||

| 13 | Hospitalisation due to Covid-19 or Complication arising from Covid-19 vaccination | |||

| Out-Patient Benefits | ||||

| 14 | Out-Patient Kidney Dialysis Treatment | As Charged, subject to any Deductible. Deductible will be waived for admission to Malaysian Government / Semi-Government Hospital. | ||

| 15 | Out-Patient Cancer Treatment | |||

| 16 | Emergency Accidental Out-Patient Treatment (within 72 hours from accident and follow-up treatment up to a maximum of 31 days) |

|||

| 17 | Day-Care Surgery | |||

| 18 | Out-Patient Physiotherapy Treatment (limit per Policy Year, within 180 days after discharge / surgery) |

5,000 | ||

| Other Benefits | ||||

| 19 | Intraocular Lens – Monofocal / Multifocal (limit per life on each eye) |

3,000 | ||

| 20 | Medical Report Fees | As Charged | ||

| Special Benefits | ||||

| 21 | Step Up Advantage | The privilege to upgrade this plan to a new medical plan without medical underwriting, subject to terms and conditions. | ||

| 22 | Compassionate Benefit | 10,000 | ||

| 23 | Emergency Assistance Program (EAP) | In accordance with the benefit provisions in EAP agreement | ||

Note:

Compassionate Benefit and Emergency Assistance Programme are not included in the Annual Limit.

Anyone between 14 days old to 70 years old (attained age) is eligible to purchase Zurich iCare Medic.

The benefits payable are protected by PIDM up to limits. Please refer to PIDM TIPS brochure or contact Zurich Life Insurance Malaysia Berhad or PIDM.