Comprehensive Coverage for Critical Illnesses and Hospital Admissions - Zurich iCare Essential

Critical protection made easy

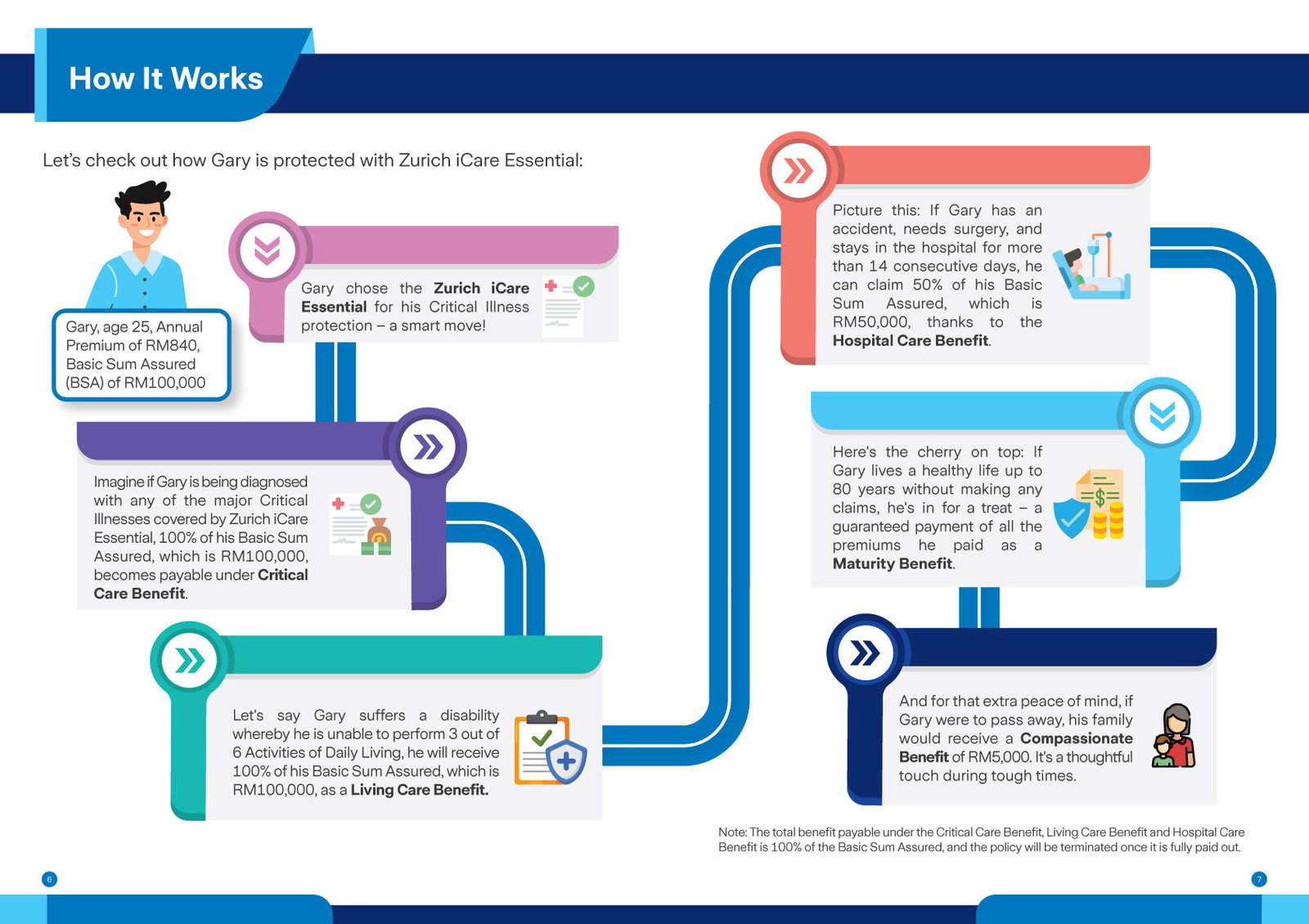

Introducing Zurich iCare Essential, a plan that not only provides exclusive coverage for major critical illnesses including heart attack, stroke, and cancer, but it also offers beyond that, covering your hospital admission events, all while staying within your budget.

Critical Care Benefit

Major critical illnesses, total payout.

100% of Basic Sum Assured will be payable for major critical illnesses including cancer, heart attack or stroke.

Major critical illnesses, total payout.

100% of Basic Sum Assured will be payable for major critical illnesses including cancer, heart attack or stroke.

Hospital Care Benefit

Beyond critical illnesses, caring for your well-being.

A 50% of Basic Sum Assured will be payable for any of the following hospital admissions, with a limit of 1 claim per benefit:

Beyond critical illnesses, caring for your well-being.

A 50% of Basic Sum Assured will be payable for any of the following hospital admissions, with a limit of 1 claim per benefit:

- Admitted to an Intensive Care Unit (ICU) for 5 consecutive days before the policy anniversary after your 75th birthday with at least one of the Essential Life Support; or

- In the event of hospitalisation for 14 consecutive days due to surgery.

Living Care Benefit

Financial support in lump sum, your resilience ally.

If you are disabled and unable to perform 3 out of 6 of your daily living activities before the policy anniversary after your 75th birthday, a 100% of Basic Sum Assured will be payable to maintain your lifestyle even in the midst of adversity.

Financial support in lump sum, your resilience ally.

If you are disabled and unable to perform 3 out of 6 of your daily living activities before the policy anniversary after your 75th birthday, a 100% of Basic Sum Assured will be payable to maintain your lifestyle even in the midst of adversity.

Compassionate Benefit

Unfortunate death, guaranteed compensation.

In the event of the Life Assured's death due to any causes, we will pay out RM5,000 to ease the family’s financial liabilities.

Unfortunate death, guaranteed compensation.

In the event of the Life Assured's death due to any causes, we will pay out RM5,000 to ease the family’s financial liabilities.

Maturity Benefit

Guaranteed payment, securing you financially.

We will give you back the Total Premium Paid, less any indebtedness, upon your policy’s maturity. If a claim is made, the maturity benefit shall be the total of the revised premium which has been adjusted based on the remaining Basic Sum Assured, across the entire policy term.

Guaranteed payment, securing you financially.

We will give you back the Total Premium Paid, less any indebtedness, upon your policy’s maturity. If a claim is made, the maturity benefit shall be the total of the revised premium which has been adjusted based on the remaining Basic Sum Assured, across the entire policy term.

The minimum entry age for this plan is 17 years old and the maximum entry age is dependent on the Life Assured's smoking status.

| Non-Smoker | Smoker |

| 50 years old | 45 years old |

The benefits payable are protected by PIDM up to limits. Please refer to PIDM TIPS brochure or contact Zurich Life Insurance Malaysia Berhad or PIDM.