Zurich-University of Oxford Agile Workforce Study: Gig Economy Rises in Malaysia, Income Protection Lags

– A study by the Zurich Insurance Group (Zurich) and the Smith School of Enterprise and the Environment at the University of Oxford on agile workforce has found that 38% of the respondents in Malaysia who are currently in full time employment, are looking to enter the gig economy in the next 12 months. This percentage is significantly higher than the global average of 20% recorded in the study.

The trend noted in the study substantiates Budget 2020 push for Malaysia’s digital aspiration and charting of economic direction to be an Asean digital powerhouse. It aligns with the nation’s focus of ‘boosting economic growth in the New Economic and Digital Era’ as outlined in Budget 2020 tabled in October 2019.

Malaysia has identified gig economy as the new source of economic growth which is sustainable and inclusive. The gig economy is expected to be included in the 12th Malaysia Plan 2021 – 2025 and is currently in the early stages of regulating the sector for the welfare of gig economy workers.

According to the Department of Statistics, Malaysia’s unemployment level is currently at a remarkably low 3.3%. However, the more than one-third contemplating on joining the gig economy will be a boon to Malaysia’s emphasis on growing the digital economy, which has allowed this new segment of the economy to thrive, more so if properly regulated and enabled.

As attractive as the gig economy is, its major drawback is that it does not provide the benefits and protection that come with full-time employment. This includes medical and personal accident insurance, employment insurance system, pension schemes, paid leave, health coverage, and minimum wage protection among other things.

Noticing the shifting trend in the workforce model, Zurich teamed up with the University of Oxford to conduct a global survey on the working-age population in 16 countries across 5 continents, including Malaysia. Approximately 18,000 working-age individuals aged 20 to 70 took part in the survey on the increasing need for agile protection of a fast-changing workforce.

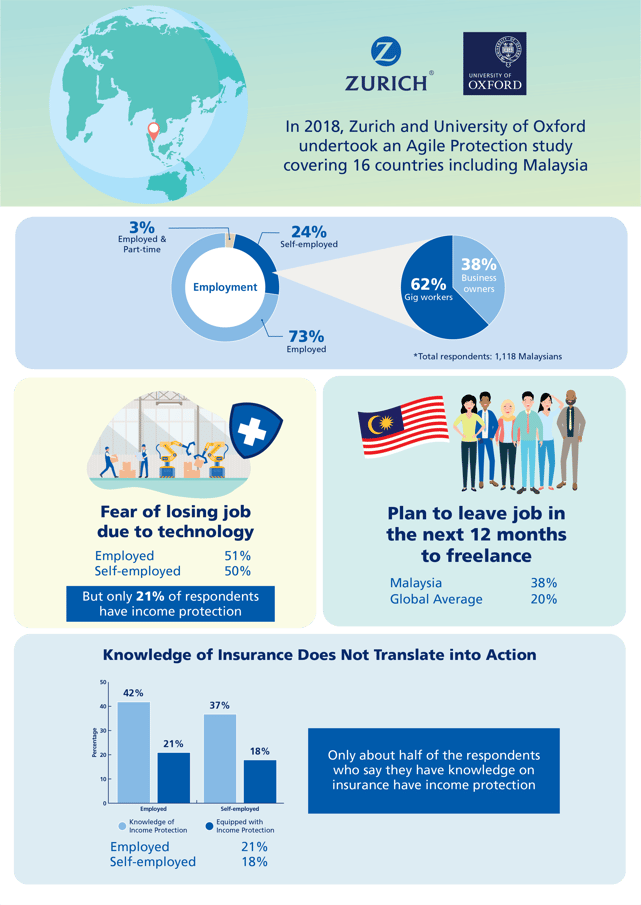

A total of 1,118 working-age Malaysians were engaged in this survey. Key findings for Malaysia include:

1. Close to a quarter (24%) of the respondents are in self-employment.

a. A higher percentage of the younger demographic (20 – 29 years) are self-employed or freelancing (24%) as opposed to the middle-aged citizens (19% of the 30 – 54 years); those above 55 years also tend to have their own businesses or turned to self-employment (47%).

b. 62% of this self-employed are freelancers; 38% have their own business.

2. 38% have plans to leave their jobs in the next year to do freelance work (significantly higher than the global average of 20%).

a. The youngest age group of 20 – 29 is the most adventurous in this regard, with 45% of them having such plans.

3. 51% of the employed and 50% of the self-employed respondents are worried of being made redundant by technology. However only 21% and 18% of the respective respondent groups have income protection or some form of insurance.

4. Should there be health problems, 17% of the employed respondents expect a 1 – 6 months income loss and 14% do not know the amount of income loss. For the self-employed, the results for the 1 – 6 months income loss is an alarming 28% while 23% do not know the amount.

5. A total of 67% of the self-employed fear becoming a burden to family and friends if something happens to them, and not having enough for a comfortable retirement.

6. Across board knowledge on insurance and income protection is at 37% for the self-employed respondents, a five percent lower than those who are in full time employment (42%).

7. The knowledge does not seem to translate to actually having income protection or insurance: only 18% and 21% of self-employed and employed respectively have some form of own income protection.

8. 20% of the respondents have multiple jobs, with the overwhelming main reason being to increase their income (50%).

The study found freelance work attractive to individuals because of flexible schedule, independence from employer, control over schedule and control over workload, in that order.

As more Malaysians join the gig economy, the low understanding of income protection and insurance will be an increasing cause for concern. This self-employed group is exposed to irregular income and is susceptible to income loss when they are unable to work due to even the slightest of situations such as having the flu or family bereavement.

Zurich Malaysia Country Head Stephen Clark commented, “Our vision is that all Malaysians have some form of protection regardless of work or situation. As a company that cares, Zurich wants to be there for Malaysians at their time of need. This study is an effort to understand and respond to the increasing need for agile protection of a fast-changing workforce. We hope the industry can come together to provide sustainable solutions and match them to individual career trajectories. It is vital that the industry evolves alongside the change in workforce trend.”

The timing of the study is opportune as it coincides and complements the efforts of the Malaysia Digital Economy Corporation (MDEC) in organising and leading the digital economy in Malaysia. MDEC works closely with 115 platform partners in the gig economy to make the new form of income generators, resilient and sustainable platforms to improve the lives of Malaysians.

MDEC’s Digital Inclusion Division Director Darzy Norhalim said, “Work lives are changing, spurred by urbanisation, digitalisation and the fourth industrial revolution. Technology has created opportunities that give rise to new ways to earn income from across industries and geographies. To-date there are 115 gig employers and 459,455 gig workers registered with MDEC. We believe there are more gig workers who are not on our register. Results from the Zurich-University of Oxford agile workforce study supports our own data and observation that the gig economy is not just a trend but is here to stay. With these results, we look forward to working hand-in-hand with industry partners to provide adequate income protection for gig workers to thrive in a digitalised economy.”

The study is part of a major three-year research programme between Zurich and the University of Oxford exploring ways to minimise protection gap for workers with flexible protection and financial support in an increasingly fragmented labor market. Launched in November 2018, the countries surveyed are Australia, Brazil, Finland, Germany, Hong Kong, Ireland, Italy, Japan, Malaysia, Mexico, Romania, Spain, Switzerland, United Arab Emirates, United Kingdom and United States of America.

The next phase of the study will involve seeking better understanding of the issue from employers’ perspectives on policies and practices.

Media Relations

Yana Rahman

Media Relations

Maryam Zainol

Zurich Malaysia

Zurich Malaysia is a collective reference term for the Zurich Insurance Group (Zurich) business subsidiaries operating in Malaysia: Zurich General Insurance Malaysia Berhad, Zurich Life Insurance Malaysia Berhad, Zurich General Takaful Malaysia Berhad and Zurich Takaful Malaysia Berhad. Zurich Malaysia offers a broad range of comprehensive insurance and takaful solutions; helping individuals as well as business owners understand and protect themselves, their businesses and their assets from risk. Zurich Malaysia has an integrated branch network in major cities nationwide as well as dedicated agency and distribution channels nationwide to serve the needs of its customers. For further information on Zurich Malaysia, visit www.zurich.com.my