Family Protection with Guaranteed Acceptance & Affordable Contributions - Takaful Al-Shams

Protect your family for your peace of mind

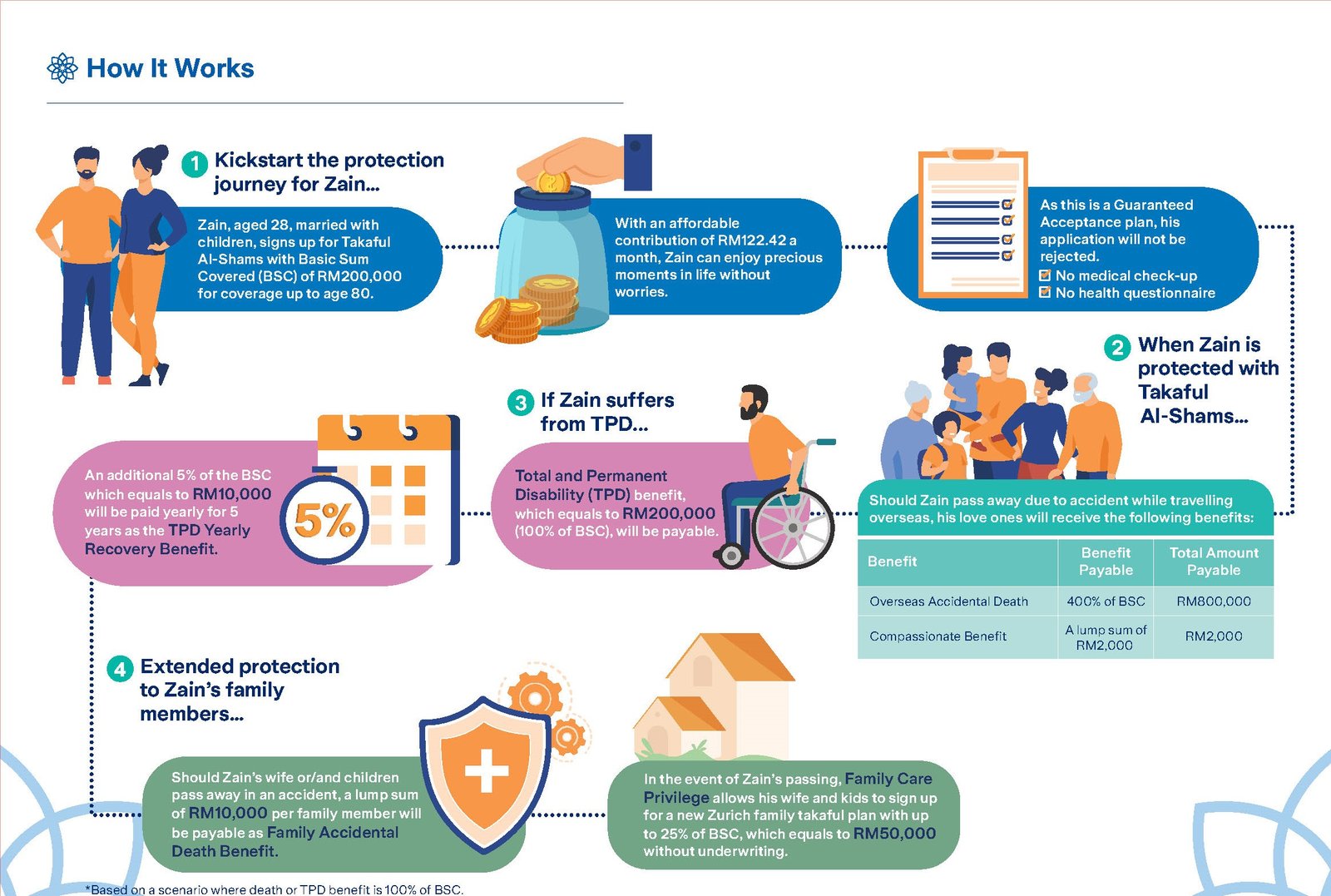

At Zurich Takaful, we help you safeguard and protect those you cherish most. Introducing Takaful Al-Shams, a Guaranteed Acceptance plan that provides protection from unpredictable events in life, including death, disability coverage as well as accidental death benefit.

Guaranteed Acceptance with Hassle-Free Application

Affordable Contribution

Takaful Al-Shams offers affordable contribution so that you can support your family without any financial worries.

Provide Financial Security1 To Your Family

Takaful Al-Shams will ease your family’s financial liabilities that may arise in the event of unfortunate incidents, as listed below:

| Death / Total and Permanent Disability (TPD) / Golden Age Disability (GAD)2 | Higher of 100% of Basic Sum Covered (BSC) or Total Contribution Made3 |

| General Accidental Death4 | Death benefit + 100% of Basic Sum Covered (BSC) |

| Public Transport Accidental Death5 | Death benefit + 200% of Basic Sum Covered (BSC) |

| Overseas Accidental Death6 | Death benefit + 300% of Basic Sum Covered (BSC) |

1 Only the highest death benefit is payable. Accidental death benefit is subject to a maximum limit of RM10,000,000 inclusive of any benefits as result of an accident payable under other certificates covering the Person Covered.

2 In the event of death, TPD or GAD (other than due to accident) of the Person Covered within the first 2 certificate years, all contributions made from the certificate inception, less any amount due to us, will be returned.

3 Total Contribution Made is defined as total contribution made under the Principal Certificate calculated based on annual mode of contribution (excluding any interest).

4 In the event of death of the Person Covered within 365 days from the date of accident.

5 In the event of death of the Person Covered within 365 days from the date of accident from commuting in public transportation.

6 In the event of death of the Person Covered within 365 days from the date of accident while travelling overseas for not more than 90 consecutive days per trip.

Disability Support Plan

TPD Yearly Recovery Benefit

Family Accidental Death Benefit

Compassionate Benefit

Family Care Privilege

In the event of your passing, up to 4 of your family members will be eligible to participate in a new Zurich family takaful plan with coverage amount of up to 25% of BSC without medical underwriting.

Note:

i.Family Care Privilege benefit is not applicable to Person Covered who passed away due to non-accidental cause within the first 2 certificate years.

ii.For further details on terms and conditions, please refer to the Product Disclosure Sheet and Takaful Certificate.

The minimum entry age for this plan is 14 days old and the maximum entry age is subject to the coverage term of your choice. However, the participant must be at least 16 years old.

| Coverage Term | Entry Age* |

| 20 years, 30 years or up to age 80 | 14 days old – 60 years old |

*Coverage term shall not exceed age 80.

The benefits payable are protected by PIDM up to limits. Please refer to PIDM TIPS brochure or contact Zurich Takaful Malaysia Berhad or PIDM.