Zurich Multi Shield

A better tomorrow for your loved ones

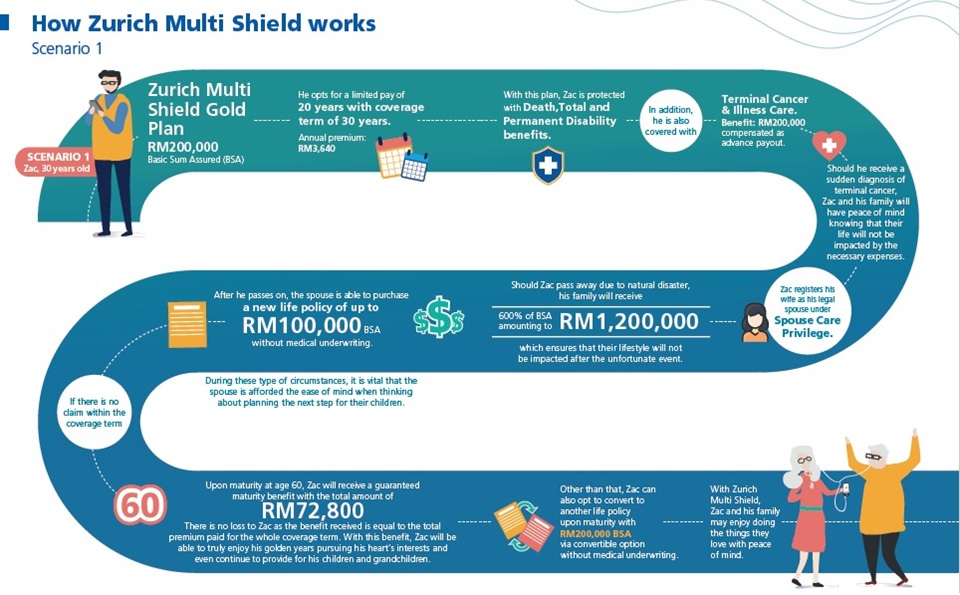

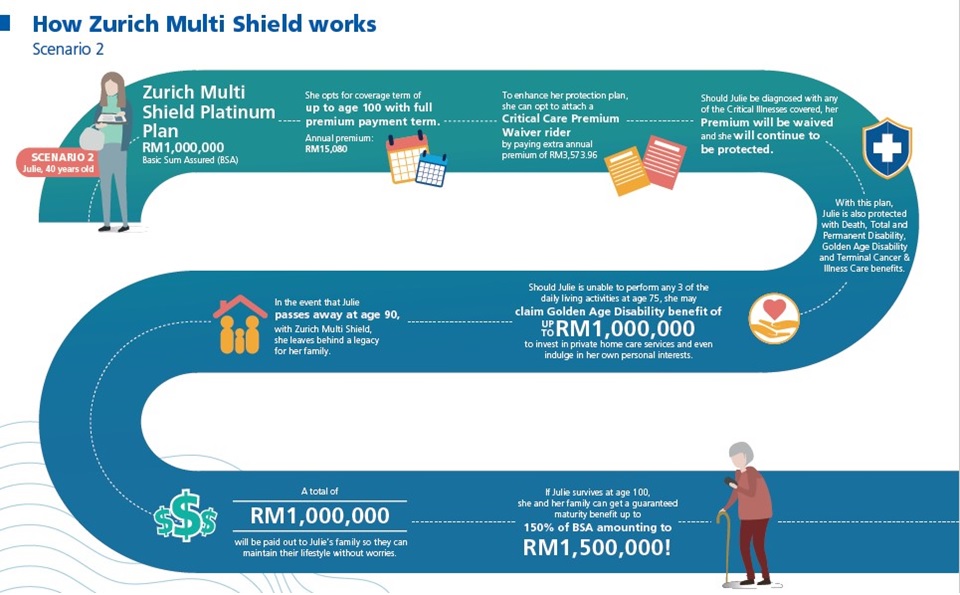

Zurich Multi Shield is a life plan that understands familial love because we have tailored it to ensure that you will be able to live your life knowing your safety and their security are assured. With benefits such as Disability Support Plan, Terminal Cancer & Illness Care, guaranteed maturity benefit, and up to 600% of Basic Sum Assured, Zurich Multi Shield is designed for the continued prosperity of your family right through your golden years with them.

Disability Support Plan1

Zurich Multi Shield provides Total and Permanent Disability (TPD) benefits up to age 70 and continuous coverage with Golden Age Disability (GAD) benefits up to age 100. In the event of TPD or GAD and if such disability persists for at least 6 months, 100%of Basic Sum Assured will be payable.

Terminal Cancer & Illness Care1

In the event of diagnosis of such ailments, such as Terminal Illness or Terminal Cancer, 100% of Basic Sum Assured will be payable.

High Protection up to 600% of Basic Sum Assured (BSA)1

Zurich Multi Shield offers high protection in the event of unfortunate incidents as listed below:

| 100% of BSA will be payable | Death |

| 200% of BSA will be payable | Balik Kampung Accidental Death |

| 300% of BSA will be payable | Public Conveyance Accidental Death |

| 400% of BSA will be payable | Overseas Accidental Death |

| 500% of BSA will be payable | On-board Flight Accidental Death |

| 600% of BSA will be payable | Natural Disaster Accidental Death |

Note:

1. Only the highest death benefit is payable.

2. For further details of terms and conditions, please refer to product disclosure sheet, sales illustration and policy documents.

1Only one of the death benefits, Disability Support Plan or Terminal Cancer & Illness Care is payable. The Disability Support Plan and the above accidental death benefits have a lifetime limit of RM10,000,000 whereas Terminal Cancer & Illness Care have a lifetime limit of RM8,000,000.

Guaranteed Maturity Benefit

Upon maturity, we pay up to 150% of the Basic Sum Assured (BSA) or 130% of Total Premium paid, depending on the coverage term, premium payment term and entry age.

| Coverage Term | Premium Payment Term | Maturity Benefit |

| Multi Shield-30 (30 years) | Pay for 5 years | 130% of Total Premium paid* |

| Pay for 10 years | 120% of Total Premium paid* | |

| Pay for 20 years | 100% of Total Premium paid* | |

| Multi Shield-100 (up to age 100) | Full premium payment term | Entry age ≤ 40 years = 150% BSA |

| Entry age > 40 years = 130% BSA |

*Total premium paid is based on annual premium mode and does not include loading (if any).

Spouse Care Privilege

Your spouse is entitled to purchase a new life policy of up to 50% of Basic Sum Assured with a capping at RM500,000 without going through the hassle of medical underwriting if you pass on.

Flexibility to Suit Your Needs

Based on your needs, we offer coverage term and premium payment term options as follows:

| Coverage Term | Premium Payment Term |

| Multi Shield-30 (30 years) | Choose from 5 years, 10 years or 20 years |

| Multi Shield-100 (Up to age 100) | Full premium payment term |

For 30 years coverage term, convertible option is available for continuous protection after your policy is matured. In addition, you can also enhance your protection with a wide range of riders.

Same Premium Across Premium Payment Term

With Zurich Multi Shield, the premium payable is guaranteed throughout the premium payment term and you may select your preferred premium payment mode.

No Medical Check-up Required

You can get higher protection without medical check-up of up to RM4,000,000. Please refer to the table below:

| Plan | Basic Sum Assured | Non-Medical Limit** |

| Multi Shield-30 Gold | RM250,000 & below | RM2,000,000 |

| Multi Shield-100 Gold | ||

| Multi Shield-30 Platinum | Above RM250,000 | RM4,000,000 |

| Multi Shield-100 Platinum |

**Depending on the selected Basic Sum Assured, age and health condition of the Life Assured.

Note:

1. All benefits payable will be deducted by the amount due to us (if any).

2. For further details of terms and conditions, please refer to product disclosure sheet, sales illustration and policy documents.

The minimum entry age for this plan is 14 days old and maximum entry age is 70 years old. For Multi Shield-30 plan with limited pay of 20 years, the maximum entry age is 65 years old. However, the policy owner must be at least 16 years old.

The benefits payable are protected by PIDM up to limits. Please refer to PIDM TIPS brochure or contact Zurich Life Insurance Malaysia Berhad or PIDM.